|

Unlock the Power of Investing |

SERVICES

Tesla Stock

Unlock the Power of Investing: A Smart Financial Move!

Investing can be a game-changer for your financial future. While a steady pay-check provides financial stability, investing can supercharge your earnings, putting your hard-earned money to work for you. A well-crafted investment portfolio can help you build substantial wealth over time, achieving your long-term financial goals, such as:

- Retirement

- Funding your children's education

- Other financial aspirations.

However, while the benefits of investing are well-known, the crucial question remains: what should you invest in? This is a critical piece of the puzzle, and getting it right is essential for success and that’s why we’re here providing the best guidelines you need.

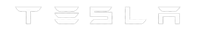

Tesla Sales Number projection with 59% growth per year until 2025

WHY STOCKS ARE AN EXCELLENT INVESTMENT CHOICE FOR ALMOST EVERYONE

Stocks are an attractive investment option for most individuals, and for good reason. Historically, stocks have consistently outperformed other investment classes, such as bonds, savings accounts, and precious metals, over the long term. In fact, stocks have delivered better returns than most investment types over almost every 10-year period in the past century.

The power of compounding is a key benefit of investing in stocks. A well-managed and traded $10,000 investment can grow exponentially, potentially reaching $175,000 or more over time. This highlights the potential for significant wealth creation through stock investments.

As a stockholder, you essentially own a portion of a business. As the company grows and becomes more profitable, so does your investment. Renowned investor Warren Buffett aptly describes investing in stocks as a bet on a business, which has proven to be an excellent strategy for over two centuries.

The stock market has consistently outperformed gold and bonds, with the S&P 500 index delivering an impressive 540% total return over the past two decades. This includes stock price gains and dividends, demonstrating the potential for significant growth.

In summary, investing in stocks offers a compelling opportunity for long-term wealth creation, making it an excellent choice for almost everyone.

Determining Your Stock Allocation: A Personalized Approach

When it comes to investing in stocks, there's no one-size-fits-all answer. Each individual's financial situation, risk tolerance, and goals are unique. However, a commonly used asset allocation guideline can provide a starting point for consideration.

The "110 minus your age" rule suggests that subtracting your age from 110 can approximate the percentage of your portfolio that should be allocated to stocks. For instance:

- A 40-year-old might consider allocating around 70% of their portfolio to stocks (110 - 40 = 70)

- A 60-year-old might consider allocating around 50% of their portfolio to stocks (110 - 60 = 50)

Keep in mind that this is merely a rough guideline and not a hard and fast rule. Your individual circumstances, risk tolerance, and investment goals should ultimately determine your stock allocation. It's essential to consult with a financial advisor like us at Tesla Stock to determine the best asset allocation strategy for your specific situation.